President Donald Trump is meeting with 10 English business leaders for breakfast this week to discuss issues relevant but not exclusive to, defense, banking and pharmaceuticals. Among the key execs invited are Sir Roger Carr, chairman of BAE Systems; John Pettigrew, CEO of National Grid; and Emma Walmsley of GSK and Barclay’s Jes Staley.

The working breakfast will last about one hour and will take place at St. James’s Palace in Central London. British Prime Minister Theresa May is co-hosting the event with Trump.

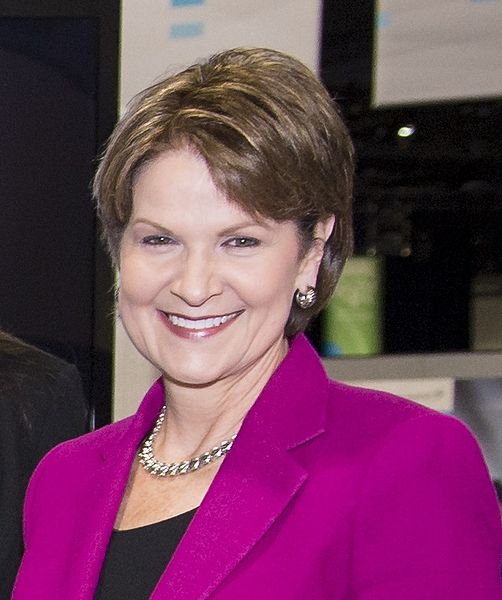

The focus of the meeting will be the crucial nature of cooperation and collaboration between English and American companies. In attendance will also be important members of the US business community, including head of Lockheed Martin, Marillyn Hewson; Estée Lauder UK and Ireland chief executive, Philippe Warnery. Fidelity Investments CEO, Abigail Johnson, is also on the list of invitees.