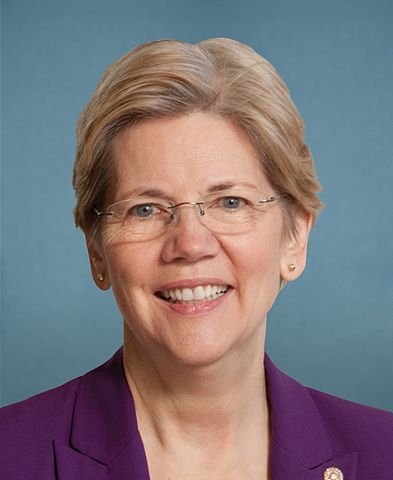

In order to get the financial system in the US to work better for average people, US Senator Elizabeth Warren, Democrat from Massachusetts, is calling on Republican law makers to take steps to reign in big banks.

Warren is calling on Republicans to break up big banks, put limits on bank executive bonuses and change tax laws to encourage financial institutions to take fewer risks with their capital. She is using the interest spurred by the current tax season to make her points, and added that her suggestions would not be hard to implement. The overall result of her talking points would be to create a more stable financial environment that would be less prone to the kind of disaster that befell the country between 2007 and 2009.

She would like to see a break-up of the largest banks by elected officials. Placing restrictions on the Federal Reserve on their lending policies to banks during financial crisis should also be implemented so banks understand that they cannot turn to the government for a bailout when things go south for them. Perhaps that realization will help the banks to act more responsibly.

Changing the tax code would also help banks and other financial bodies to refrain from taking too high risks, or indulging in unfair banking practices. Lawsuits filed have shown that many bankers had persuaded homeowners into mortgages that they could not afford and would not qualify for. The bankers said that they could skip paying their mortgage or pay a lower amount until they went through the process. Then the banks turned around and tried to foreclose on the home when the homeowners were disqualified from the program, according to the lawsuits.